Experience Global Tax in Real-time

Special Offer for TEI Members

Modeling GILTI HTE and Biden/Wyden Proposals

Are you interested in modeling the GILTI high-tax exclusion and/or related legislative changes proposed by the Biden Administration or Senator Wyden?

Please schedule a call to arrange an informational session followed by a customized modeling session using your own information.

Expires May 31, 2021.

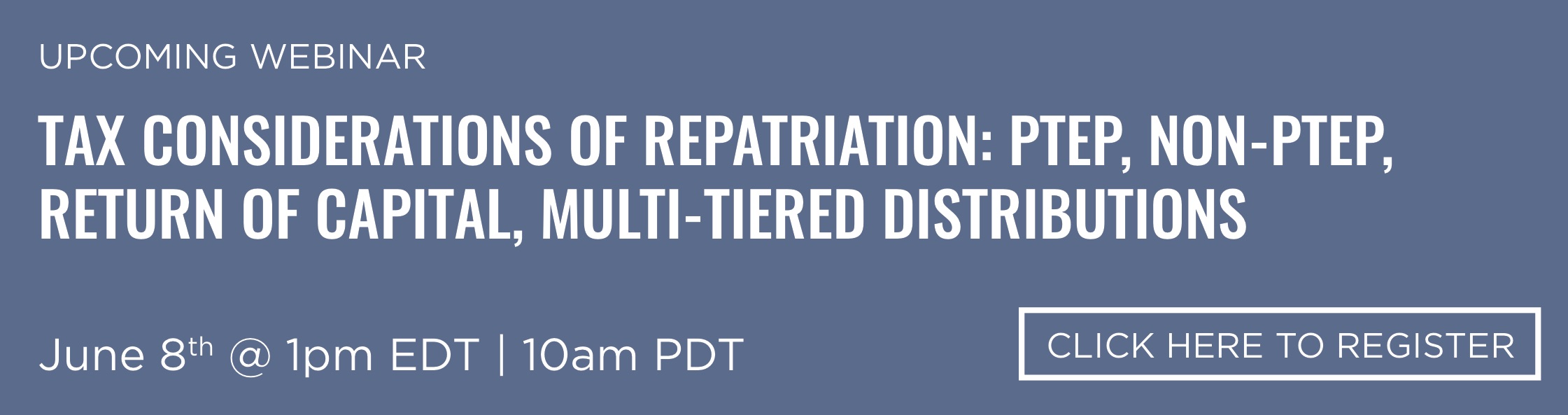

We have a limited amount of comp passes available for the 6/8 webinar, please email Allison Lavigne at [email protected] to request.

We are pleased to offer thought leadership at a time when international tax is more complicated than ever.

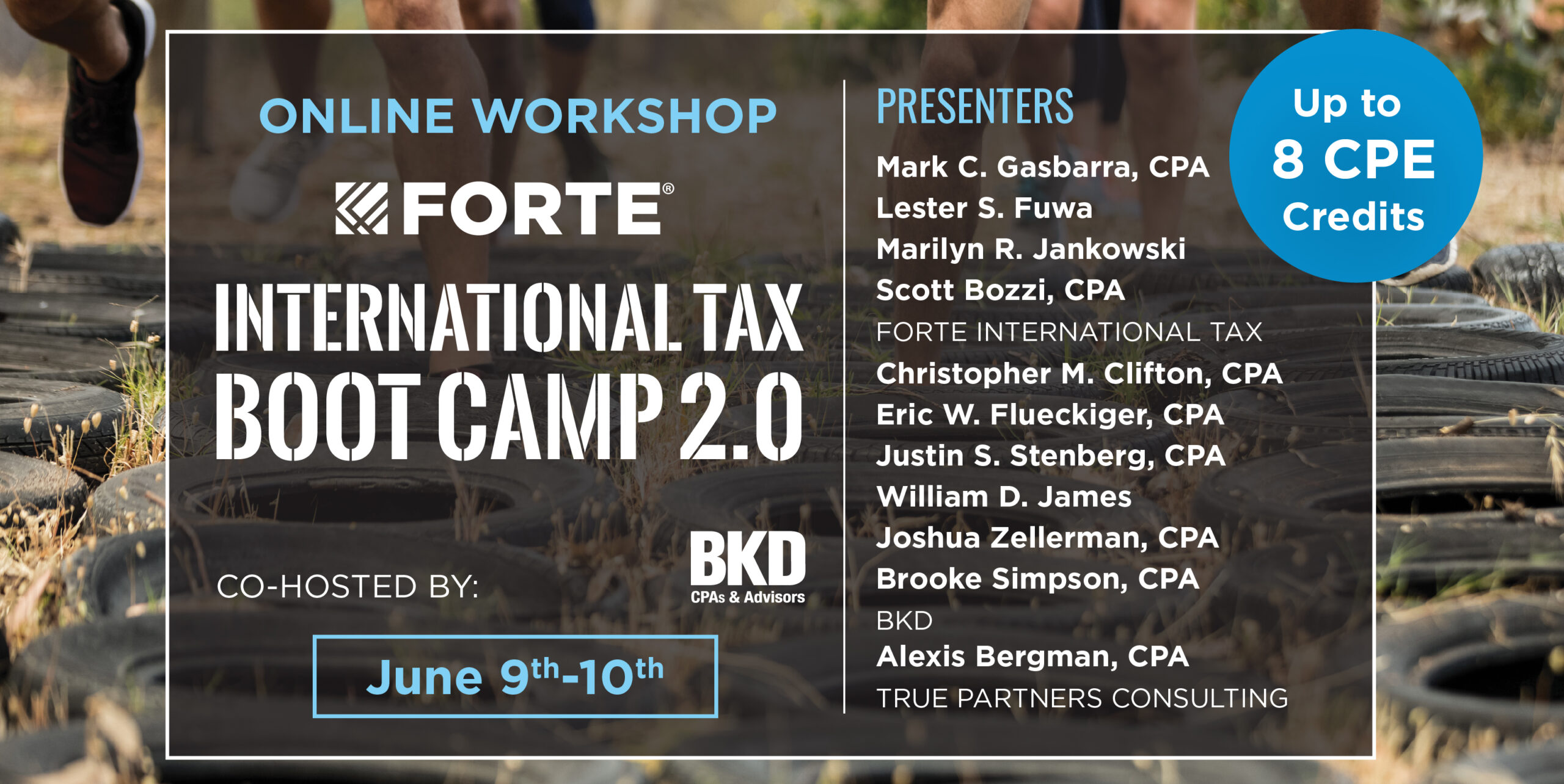

Join our upcoming International Tax Boot Camp LIVE Online Workshop June 8th-9th covering 2020 compliance requirements and late breaking developments including the Biden Administration’s Green Book providing up to 8 CPE Credits.

This live online workshop covers all international tax aspects of international taxation, including transfer pricing, GILTI, FDII, FTC, 163(j) and BEAT. The latest tax technical content is explained and then implemented through fully integrated case studies that the participants will work though using VantagePoint.

Alternative modeling scenarios will cover aspects of both proposed and final tax regulations, including the apportionment of Stewardship and Research and Experimental deductions, and the use of the GILTI high-tax exclusion and insights into modeling the Biden and Wyden international tax proposals.

Case Study tax results will also be mapped to the 2020 International Tax Forms, giving participants an advanced guide to the latest international tax reporting requirements.